Mutual funds have completely dominated the Indian financial markets. Their popularity has risen in recent years, and many investors now consider them to be the best investment alternative.

Investors are looking for the best platforms to invest in mutual funds as they become more aware of mutual funds, the benefits they provide to a portfolio, and the importance of participating in mutual funds regularly.

Let’s take a closer look at mutual funds, their types, and the best application to invest in them:

Table of Contents

What is Mutual Funds?

In a nutshell, Mutual funds are financial instruments in which money is gathered from investors and pooled by the fund manager in order to invest in securities such as stock, debt, and other types of securities. Because of this concept, you can invest in good companies even if your investment amount is as low as Rs 500.

A mutual fund is a professionally managed trust that combines the money of many investors and invests it in securities such as stocks, bonds, short-term money market instruments, and commodities like precious metals.

The sole prerequisites for investing in Mutual Funds are having a bank account and completing the KYC process. Mutual funds are a type of investment that depends on your investment goals and time horizon as follows :

- You can invest in a mutual fund for a short or extended period of time.

- You have the option of investing in a debt fund, an equity fund, or a hybrid fund.

- If you are a paid individual, you can invest in a SIP plan, which invests your money at regular periods. If you work as a freelancer, you can invest a lump sum amount in a debt/liquid fund and then transfer and invest to the mutual fund of your choice on a regular basis using a SIP plan.

- SIP (Systematic Investment Plan) is a method of investing in mutual funds in a consistent quantity over time. Investing in mutual funds through a systematic investment plan (SIP) is similar to watering a plant on a regular basis and watching it grow from a seed to a huge tree. SIP plans help you build wealth by investing your money on a regular basis.

Mutual Funds Come in a Variety of Forms:

Mutual funds are divided into three categories:

- Equity mutual funds

- Debt mutual funds

- Hybrid mutual funds

Types of Mutual Funds

Equity Mutual Funds

Mutual fund schemes that invest primarily in stock and stock-related securities of various corporations. Stock investments are riskier than traditional savings products such as bonds, fixed deposits, and so on.

Debt Mutual Funds

These funds generally invest in debt assets that generate a fixed income. The items that make up the foundation Debt funds’ primary goal is to provide consistent returns over a short period of time.

Hybrid Mutual Funds

Hybrid mutual fund schemes invest in a combination of equity and debt assets to take advantage of the benefits of both while lowering the portfolio’s fundamental risk. Stocks provide a significant boost to the portfolio’s overall returns, whereas debt securities provide stability to the fund portfolio.

There are other ways to invest in mutual funds, but the most convenient is to use a mutual fund app. You will be able to invest in several funds via mobile apps, which will provide you with higher returns and help you make more money in the long run.

Invest in Mutual Funds Only If You Know What You’re Doing: If you can’t describe how a mutual fund invests, what its underlying assets are, what the dangers of the mutual fund’s investment strategy are, and why you possess a particular mutual fund quickly, simply, and with detail, you certainly shouldn’t have it in your portfolio.

Consider a 5-year or longer time frame: If you can ride through the sometimes nauseating waves of market volatility that come with investing in stocks or bonds, it’ll be far easier to let your money compound.

Furthermore, in today’s digital age, everything is done by simply pressing a button on a mobile device. Investing in Mutual Funds can be done through a variety of applications.

7 Best Mobile Apps to Invest in Mutual Funds

Zerodha Mutual Funds App

Zerodha coin is ranked first among the finest mutual fund investment apps. They allow investors to invest directly in SIPs across 34 investment houses. On a direct SIP, you can easily invest and save up to 1 to 1.5 percent more than the actual amount.

Zerodha is well-known for its large active client base; similarly, this app has amassed a sizable customer base, making it the preferred app among investors. Because the funds are held in Demat format, it is easy to provide leverage for a loan. Zeordha is one of the easiest and best mutual fund app for investment and get better returns.

Key Features of this application:

- The user of the app can simply browse and filter the over 3,000 commission-free direct mutual funds available, as well as buy them.

- One of the most profitable options is equity brokerage, which costs as little as Rs.20 per order.

- The application keeps mutual funds in Demat form, making it easy to keep track of your capital market investments electronically.

Advantages of Zerodha:

- It was the first stock brokerage firm to offer “discount broker” services.

- At Rs 20 per trade, it has a cheap brokerage.

- Provides excellent trading platforms for a positive trading experience.

- With its good innovation entitled “Zerodha Varsity,” it provides training and education to its clientele.

- For stock trading, it offers a ‘zero’ brokerage.

Disadvantages of Zerodha:

- Its clients are given less publicity.

- Clients are not permitted to invest in initial public offerings.

- Doesn’t provide research-based advice or suggestions.

Groww Mutual Funds Investment App

Groww was founded in 2017 is one of India’s fastest-growing investment platforms. Groww has managed to carve out a niche for itself in the wealth management industry, despite stiff competition. The app’s main feature is that it allows investors to invest directly in mutual funds, create SIPs for free with no commission, and track the mutual funds they have invested in. The Groww app’s USPs are transparency and simplicity. Groww is one of the best mutual fund apps to invest in equity, hybrid and other types of mutual funds.

Key Features of this application:

- Invest in mutual funds that are managed directly.

- Invest in stocks and apply for initial public offerings (IPOs).

- Invest in stocks and fixed deposits in the United States (only on website)

- Keep track of outside mutual funds.

Advantages of Groww :

- The user interface is simple and clutter-free.

- If you don’t want to use your bank account, you can pay your SIP using your Groww balance.

- Customer service that is available at all times

- SIP amount and date can be skipped or changed.

Disadvantages of Groww :

- From time to time, technical difficulties and hitches occur.

- If you want to buy US Stocks, then it will take lots of time to transfer money to Groww account.

ETMoney Mutual Funds Investment App

ETMoney is a full-featured software that allows you to invest in direct mutual funds, keep track of your spending, and receive automated bill reminders. It also offers various financial services based on your profile, such as health/life insurance, fixed deposits, NPS, loans, and tax preparation. ETMoney offers no-commission mutual fund investing. That implies you won’t have to pay any commissions or brokerage fees if you invest in any mutual fund plan.

Key Features of this application:

- Invest in mutual funds that are managed directly (including ELSS)

- NPS, fixed deposits, and insurance (health, term life, car/bike)

- Check your credit score for credit cards and loans.

- Liquid fund SmartDeposit

- Integrated expense manager and bill reminders

- Keep track of outside mutual funds.

Advantages of ETMoney :

- The investment procedure is quick and simple.

- They send an email acknowledgment right away, and the app displays the transaction’s status along with a tentative date for the transaction to appear in the app.

- To investigate and choose mutual funds, you’ll need a lot of information.

- It is a one-tap payment system.

- SIP amount and date can be skipped or changed.

- Understand your investor profile.

Disadvantages of ETMoney :

- Customer service needs improvement.

Kuvera Mutual Fund App

Kuvera is a personal finance app that allows users to invest in direct mutual funds, term deposits, digital gold, Indian and US equities, and exchange-traded funds (ETFs). It also supports cryptocurrencies, something that none of the other apps on the list do. You may also track and import your EPF.

While there are fees associated with opening an account in the United States, mutual fund investments are entirely free. The programme provides you a good idea of which categories to invest in based on your risk tolerance, ranging from fixed deposits to mutual funds and stocks.

Key Features of this application:

- Invest in mutual funds that are managed directly.

- Stocks from India and the United States, fixed deposits, and gold funds are recommended depending on your goals and characteristics.

- External mutual funds, equities, gold, and EPF are all tracked in one spot.

- Liquid fund from SaveSmart

- Manage and import your family accounts.

Advantages of Kuvera :

- Tax Harvesting can help you save money on LTCG taxes.

- With Trade Smart’s goal-based investment planning, you may save money on switching expenses.

- SIP can be skipped or the amount and date can be changed.

Disadvantages of Kuvera :

- There isn’t a fingerprint unlock option.

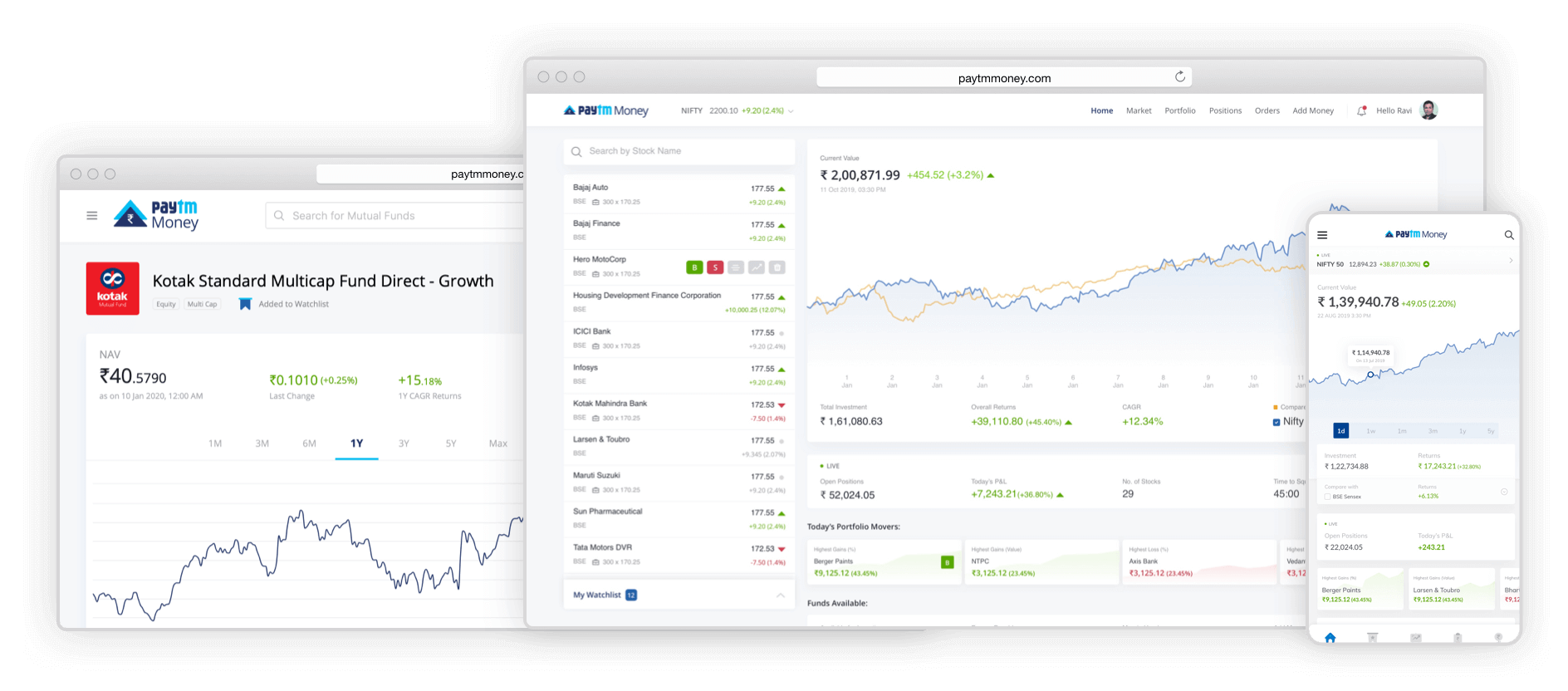

Paytm Money App

Another famous mutual fund app in India is Paytm Money. The app features a user-friendly layout with a variety of options for finding mutual funds based on categories and investment ideas. It displays the best funds based on their performance, ratings, and category winners.

Key Features of this application:

- Invest in mutual funds that are managed directly.

- Stocks, digital gold, and the NPS Super Saver liquid fund are all options.

- Keep track of outside mutual funds.

Advantages of Paytm Money App :

- Pause or change the amount and date of your SIP.

Disadvantages of Paytm Money App :

- Customer service is lacking.

- Interface is overburdened

- NAV delay issue when changing default bank account in the app

Paisabazaar

Paisabazaar is an integrated platform that offers one-stop financial solutions in a variety of financial instruments such as insurance, loans, credit cards, mutual funds, and FDs, among others. The platform serves as both an investment platform and an investment tracker. It also offers the option of investing in ‘Direct Mutual Funds,’ which include a variety of options such as Equity Funds, Balanced Funds, Debt Funds, and others.

Key features of the application:

- The app provides clients with useful solutions in the areas of personal loans, business loans, insurance, and direct mutual fund schemes.

- They contain tools that allow customers to open an online savings account, apply for loans, get insurance, and even check their credit score.

- Furthermore, in this application, they have a high potential for cross-selling and upselling.

Advantages :

- Invest in mutual funds that are managed on a one-on-one basis.

- Investors can choose the funds from their past performance.

- The app can be used as an investing platform as well as a tracker of investments.

Disadvantages :

- There is no way to contact customer service.

myCAMS Mutual Funds App

Opening new folios, searching through numerous mutual fund investment schemes, acquiring, redeeming, setting up SIPs, or opting for Common One Time Mandate are all available through the myCAMS app (OTM). Investors can also change their default bank mandate and schedule transactions. If family members are also investing, it also provides a PAN level view, as well as the ability to set a watch list to track actions.

Key features of the application :

- The software assists clients in locating the best financial instruments, purchasing them, and managing them without paying any brokerage costs.

- Customers may also get rapid loans and insurance policies, keep track of their spending, and enroll in direct mutual fund investment programmes with ease.

- Systematic Investment Plans and lump-sum investments are also options for investing in mutual funds. SIPs in ELSS mutual funds might also help you save money on taxes.

Advantages :

- The procedure for making an investment is extensive and efficient.

- Customers can also apply for short-term loans and insurance coverage.

Disadvantages:

- The customer service department is behind the times.

Frequently Asked Questions About Mutual Funds

In this article we have listed best apps for mutual fund investment including Zerodha, Groww, ETMoney, Paytm and many more. All these apps are best for mutual fund investments.

Groww is one of the best app for mutual fund SIP. Once you select any mutual fund for SIP investment then it will easily set up the payment which will deduct monthly SIP automatically from your bank account. Groww app also have the wallet option which allow you to add money in wallet and Groww will automatically deduct money from the wallet.

All mentioned mutual fund apps in this article including Zerodha, Groww, ETMoney and Paytm are absolutely free and doesn’t have any charges.

Mutual Fund are completely based on the market. If you understand the mutual fund and stock market then it’s the safest format for longer term. Before investing in any mutual fund first understand the portfolio of that fund and invest accordingly.

Conclusion :

We recommend that anyone interested in investing in mutual funds check out this platform at least once because it makes the entire procedure straightforward and painless.

Happy Investing!