A personal loan can be used to meet any of your personal financial needs, such as paying for an unexpected medical expense, a dream destination wedding expense, an exotic holiday vacation, paying for a one-time premium term insurance policy, or investing in mutual funds for long-term investment gains, as the name suggests (provided personal loan ROI is attractive). The borrower must repay a personal loan in equal monthly installments, or EMIs, just like any other loan.

Table of Contents

What is Personal Loan?

A personal loan is taken by an individual to meet his or her personal needs, as previously stated. It signifies that a personal loan has no predetermined end-use. It can be used for a variety of things, including covering medical expenses, paying for a family trip, funding your child’s further education, upgrading your home, and making large-ticket purchases.

Earlier if you need to take any kind of loan then you needs to visit any bank branch with tones of document and it takes ample of time. Currently Indian finance industry is growing rapidly thus if you need personal loan then you can easily apply for various personal loan apps by seating on couch comfortably at your home. As mentioned earlier if you need any loan from bank then it’s only education loan, vehicle loan, home loan and other pre-defined loans.

If you need any personal loan then you need to borrow money either from any relatives, friends or those who lends money but, the interest rate for those kind of personal loans would be much higher. Now various personal loan apps provides you loan in simple and easy steps so, we will discuss that in detail.

Now that you know about the definition and use of a personal loan, let’s talk about personal loan app features and benefits.

- Approvals and disbursements are completed quickly.

- Easy eligibility standards and a high degree of flexibility

- There is no obligation to pay a security deposit.

- Documentation that is easy to understand.

- Features that are easy to use.

Before we get started, let’s go over the documentation you’ll need to apply for the personal loan:

Documents Required for Personal Loan App

- Identity proof (Aadhar card/Voter ID/PAN card/Driving license)

- Address Proof(Voter card, Aadhar card, Passport, Utility bill)

- Aadhar Card

- Original Photo

- Bank Account information

- Company information and email address.

- Income Proof

(p.s. : these are the fundamental paperwork; some of the applications may require additional documents)

14 Best Instant Personal Loan Apps in India

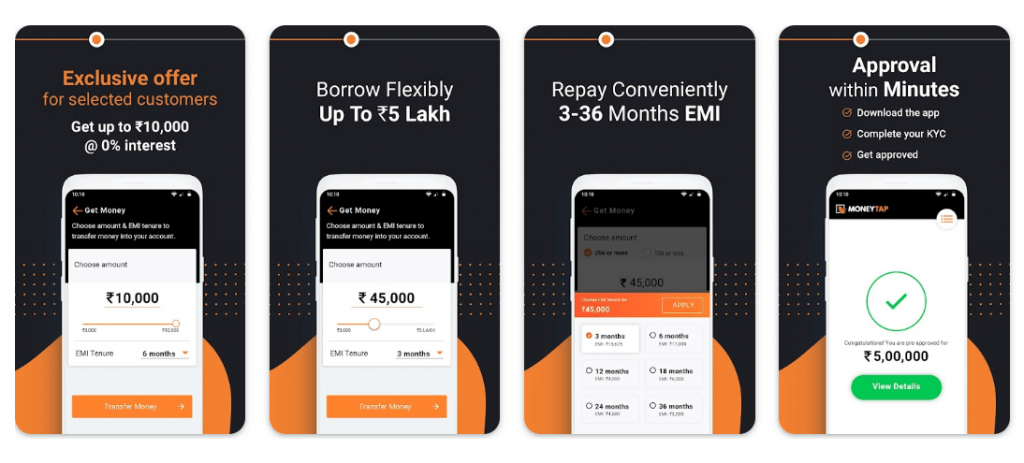

#1 Freo (Earlier MoneyTap)

MoneyTap is the first app-based credit line in India. A personal credit line is a personal credit line, not a personal loan or credit card. They offer small-to-medium cash loans, as well as fast credit and flexible repayment choices. MoneyTap is available in more than 40 cities, and customers can acquire a credit limit of up to Rs. 5,00,000 for a period of 2 to 36 months, with monthly interest rates starting at 1.08 percent.

MoneyTap Interest Rates, Fees and Charges

| Interest Rate | Processing Fee | Loan Amount |

| 13% p.a. onwards | 2% + Service Tax | Up to 5 lakhs |

Benefits of MoneyTap Instant Loan App:

Some of the key features and benefits of MoneyTap Loans are listed as follows:

- The approval process for a MoneyTap Loan is lightning fast.

- The approval process is also one-time, so the next time you apply for a MoneyTap loan, the process will be even faster than the first.

- With MoneyTap, the interest is levied only on the funds that you withdraw, not on the total amount of funds sanctioned for you.

- The interest applicable will depend on a number of factors, and also on the bank that the company has partnered with.

- MoneyTap provides customers with a variable loan repayment term to make repaying easier.

- A loan for as little as Rs.3000 or as much as Rs.5 lakh can be applied for.

Customer Care Details of MoneyTap

Email- [email protected]

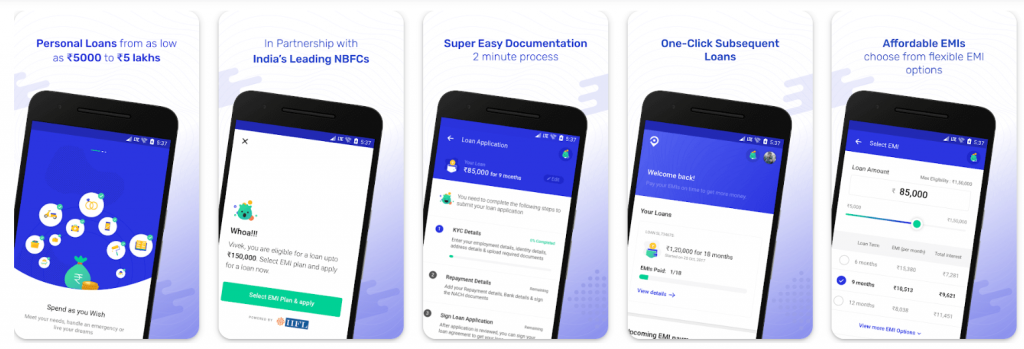

#2 PaySense

PaySense offers personal loans ranging from $5,000 to $5,000,000 with an APR ranging from 16 percent to 36 percent on a declining balance basis. PaySense is available in more than 60 Indian cities, including Mumbai, Bengaluru, Kolkata, Chandigarh, Chennai, and the National Capital Region (NCR). Credit Saison India, Fullerton, IIFL, and PayU Finance are some of the NBFCs/Banks that PaySense has partnered with.

PaySense Interest Rates, Fees and Charges

| Interest Rate | Processing Fee | Loan Amount |

| 1.4% to 2.3% per month | Up to 3% | Up to 5 lakhs |

Features of PaySense Instant Loan App

Some of the key features and benefits of PaySense Loans are listed as follows:

- It has a low-interest rate policy.

- It also offers EMIs that are both handy and inexpensive.

- The loan application takes less than 5 minutes to complete.

- All of the processes are entirely digital.

- Even if you have a bad credit score, you can still acquire a loan.

Customer care Details:

#3 Dhani

IndiaBulls, one of India’s leading financial organizations, has just launched the Dhani App. The Dhani App is more well-known in the public because it assists people in managing their finances. This app can also assist with shopping and loan applications. The Dhani App is far too simple to obtain. The Dhani application is available on the Google Play Store and the Apple App Store for Android. We’ll show you how to get it from Android apps in the following steps.

| Interest Rate | Processing Fee | Loan Amount |

| 13.99% p.a. onwards | 3% onwards | Rs.1,000 – Rs.15 lakh |

Features of the Dhani Personal Loan App

Some of the key features and benefits of Dhani Loans are listed as follows:

- Dhani’s Phone Se Loan app allows you to apply for a Dhani Loan of up to Rs. 15 lakhs, and the funds will be paid into your account immediately.

- To receive a Dhani Loan, all you have to do is show confirmation of your identity (with the help of an Aadhaar card and address proof). The Dhani Loan will be approved and transferred to your account in around three minutes if you qualify.

- You can use the software from anywhere and on any smartphone to seek and get a Dhani Personal Loan at any time.

- Apart from applying for a Dhani Loan, the app allows you to track and manage your loan account as well as pay your dues.

Customer care number Dhani apps :

You can reach out to our customer service center between 8:00 AM and 8:00 PM.

Dhani Loans: 0124-6555-555. Email: [email protected]

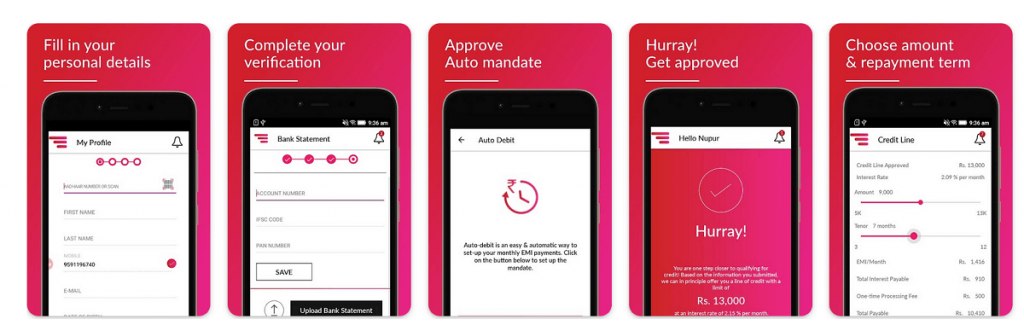

#4 Nira

You can get a quick NIRA personal loan of up to Rs. 1 lakh online at a low-interest rate of 24 to 36 percent per annum. The repayment period ranges from three to twelve months. After three months, you can prepay the loan with no further fees. In addition to the interest rate, the borrower may be charged a processing fee of up to 2% of the loan amount.

Features of the NIRA Personal Loan:

Some of the key features and benefits of NIRA Loans are listed as follows:

- The loan will function similarly to a credit card, with a pre-determined limit that you can spend as you choose.

- The least loan amount is Rs. 5,000, and the highest loan amount is Rs. 1 lakh.

- Interest is payable at a rate between 2% and 3% every month (or 24 percent to 36 percent ).

- According to their unique formula, interest rates are based on credit scores.

- The loan works in the same way as a credit card, except that the loan must be repaid in equal monthly installments (EMIs).

- Loan periods range from three to twelve months, with one-month increments between Three months, four months, and five months.

The Customer Care Number for the NIRA Personal Loan

If you have any queries regarding the personal loan, you can contact NIRA Customer Care Division at the following numbers:

- +91 6363531535

- +91 9591196740

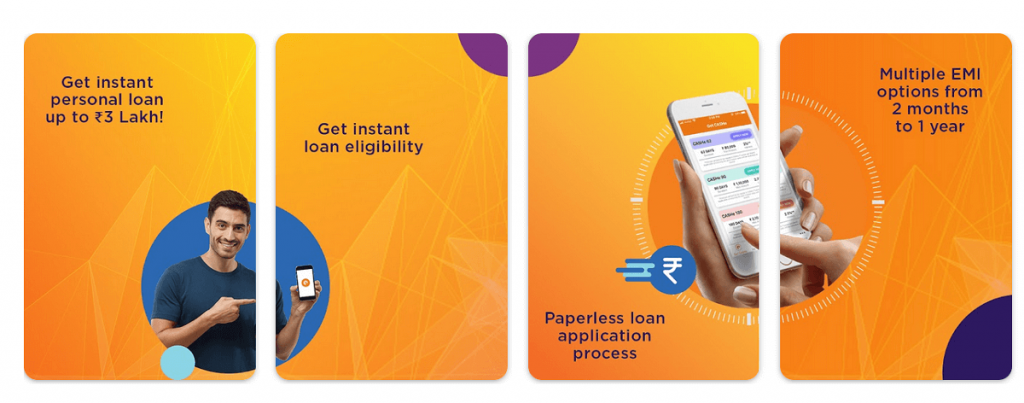

#5 CASHe

CASHe is a loan app that provides quick personal loans up to Rs. 2 lakhs with no security or collateral required. These personal loans can be used for anything, including purchasing electronics, weddings, vacations, medical emergencies, home repairs and restorations, and so on. The interest rate for CASHe Loans starts at 2.75 percent per month, with a variable duration of 62 days, 90 days, 180 days, 270 days, or 1 year. For Android and iOS users, the CASHe app may be downloaded from Google Play and the App Store. The CASHe app offers salaried people fast cash loans. You can use CASHe to apply for a personal loan at any time.

Features of CASHe Personal Loan:

Some of the key features and benefits of CASHe Loans are listed as follows:

- The CASHe loan can be used for various purposes, including purchasing electronic devices, wedding expenses, vacation planning, medical emergencies, home repairs and renovations, and so on.

- The minimum and maximum amounts offered by CASHe are Rs. 1,000 and Rs. 4 lakhs, respectively.

- The CASHe interest rate begins at 2.25 percent per month and can rise to 2.50 percent per month, depending on the selected payback period.

- Repayment terms range from 90 days to 180 days, 270 days to 360 days to 540 days. The repayment can be made simply through the CASHe app.

- Processing Cost: Depending on the loan size and term, the processing fee for a CASHe loan can be up to 3% of the loan amount.

The Customer Care Number for the CASHe Personal Loan :

Any questions or CASHe concerns should be sent to [email protected] or [email protected], respectively, to the CASHe customer service team. There is no CASHe customer service number because CASHe does not communicate with customers over the phone.

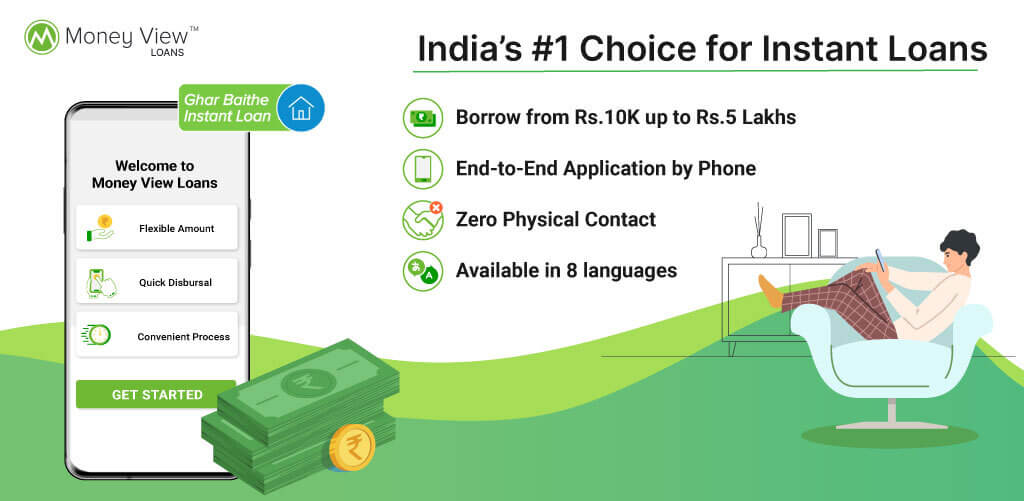

#6 Money View

Money View is one of the popular NBFCs for customers to get an instant personal loan. The loan disbursal under Money View can be as quick as within 24 hours of application. The details of the instant short-term loans of Money View are mentioned hereunder.

Features of the money view:

Some of the key features and benefits of Navi Money View are listed as follows:

- The loans available under the instant short-term loans of Money View can be as low as Rs. 10,000 up to Rs. 5,00,000.

- Customers can choose the amount of loan based on their requirements.

- Customers can pay the loan within the tenure, ranging from 3 months to a maximum of 60 months or 5 years.

- The rate of interest offered by Money View is very affordable and reasonable as per market standards.

- The loans from Money View are instantly disbursed upon receiving the application and verification of the documents.

- Money View offers the applicants instant eligibility checks in order to get the loan processed.

- The entire loan process of Money View is digital. All the stages of instant short-term loans from Money View are done digitally.

The Customer Care Number for the Money View Personal Loan :

Customer Care No.

080 4569 2002

Loan Payment Queries

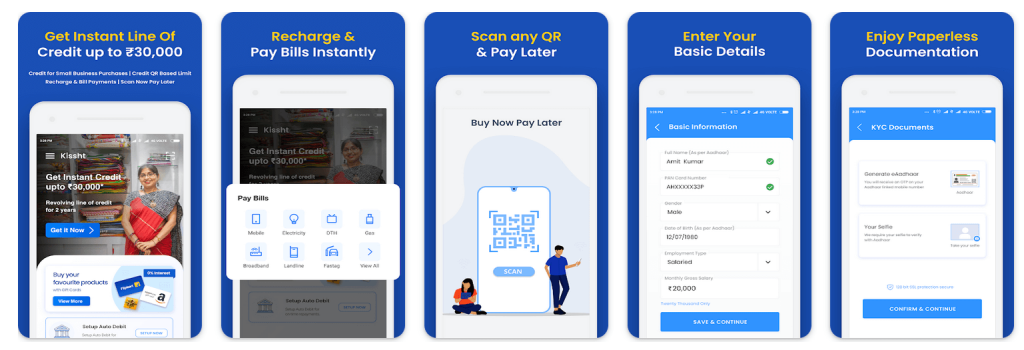

#7 Kissht

Kissht is a quick loan app that can be found on both the Google Play Store and the App Store. It’s one of the best personal loan options for students, freelancers, and small business owners who don’t have a steady paycheck. Within five minutes, Kissht can provide a QR-based revolving line of credit. Kissht simply needs your Aadhar card to conduct the eligibility check, approve the personal loan, and deposit the funds instantly into your bank account. The highest loan amount is Rs 2 lakhs, with interest rates ranging from 14% to 30% per annum. It’s an appealing offer because it’s a completely digital procedure.

Features of the Kissht Instant Loan App :

Some of the key features and benefits of Kissht are listed as follows:

- Instant loan approval: With the Kissht app, you may acquire a loan approval in seconds. After uploading the required documents, you will receive instant approval and speedier disbursement.

- Multiple Repayment Alternatives: You have a variety of repayment options to make it easier to repay your loan. For loan repayment, you can choose from any of these options.

- Multiple brand options: Kissht has partnered with prominent retailers to let you enjoy online shopping. You can choose and shop from a selection of prominent companies such as Samsung, MakeMyTrip, and Carat Lane, among others.

- There is no paperwork required when you apply for a loan through the Kissht app. This app uses a completely digital procedure that does not require any paperwork.

The Customer Care Number for the Kissht Personal Loan :

Email at [email protected]

WhatsApp on 02248913044

Call on 022-62820570

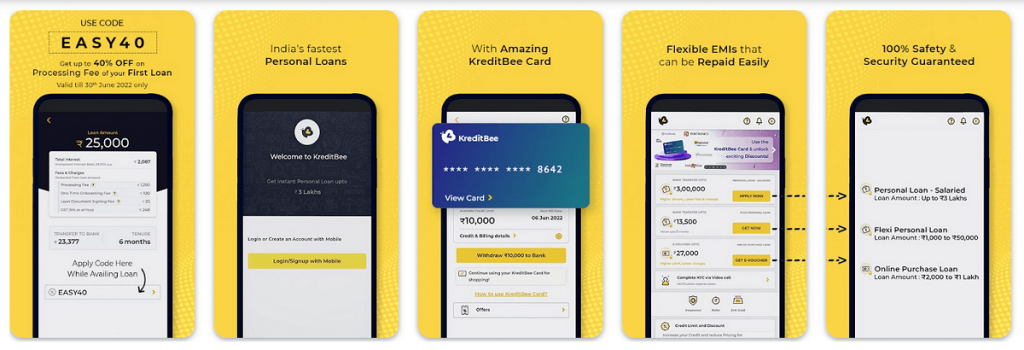

#8 KreditBee

KreditBee is a quick personal loan app that offers self-employed and salaried professionals personal loans ranging from Rs 1000 to Rs 200000 based on their credit score. It had an interest rate ranging from 0% to 29.95% per year for a period of days to 15 months. It simply requires a few documents to apply for a loan, and the full loan process, from registration to distribution, takes no more than 15 minutes.

Features of the KreditBee Loan App

Some of the key features and benefits of KreditBee are listed as follows:

- From registration to a direct bank transfer, the KreditBee loan app approves quick personal loans in around 15 minutes.

- This loan software offers shopping EMIs for online purchases in areas such as fashion, electronics, travel, furniture, and more.

- It also maintains client transparency, such as loans sanctioned by RBI-certified NBFCs or BANKS, which are lending partners of this company.

- This business offers variable interest rates ranging from 0% to 29.95% per year.

The Customer Care Number for the KreditBee Personal Loan :

080-44292200

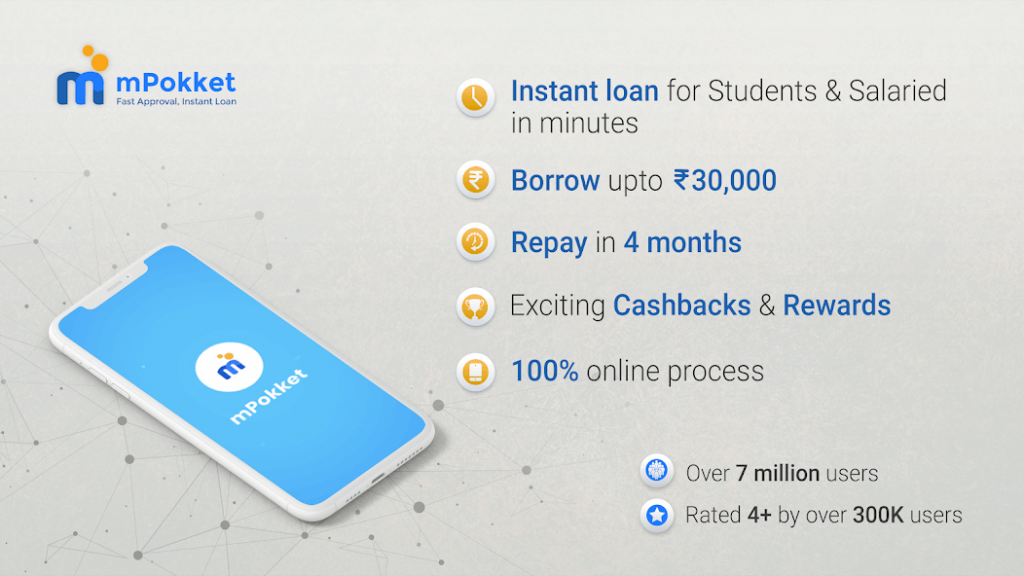

#9 mPokket

mPokket is an app that offers students and salaried professionals secure and instant personal loans with loan amounts ranging from Rs 500 to Rs 30,000 and interest rates ranging from 2% to 6% per month for terms ranging from 61 to 120 days. This is the most effective app for obtaining salary and student loans. This app can provide immediate loans to college students and salaried individuals.

Features of mPokket loan app:

Some of the key features and benefits of mPokket are listed as follows:

- In minutes, the mPokket lending app offers customizable loan sums ranging from Rs 500 to Rs 30,000.

- This is an entirely paperless loan application.

- You can get a loan without putting up any collateral.

- mPokket provides dedicated customer service for personal loans.

- The sensitive information you provide in this app is protected by this app.

- It provides a flexible repayment option by transferring the loan money to a bank/Paytm account in 2 minutes.

- It also provides incentives for prompt payments.

- Processing fees range from Rs 34 to Rs 203, including 18% GST.

- The monthly interest rates on this loan range from 1% to 6% per month.

The Customer Care Number for the mPokket Personal Loan :

Contact the customer care number to more details : 033- 6645 2400

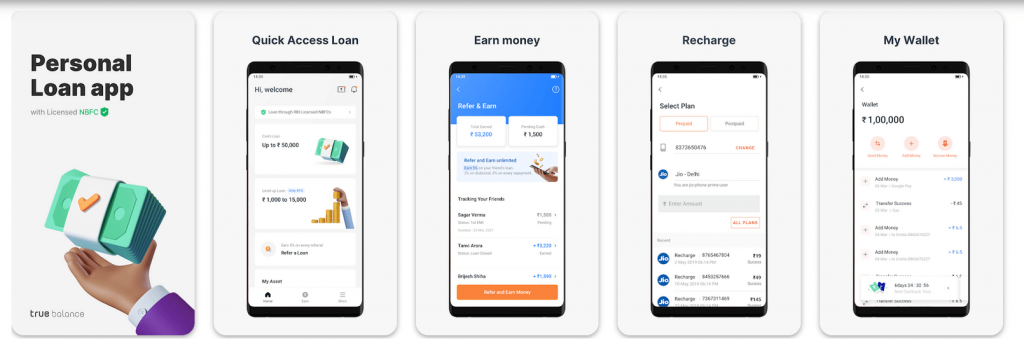

#10 True Balance

True Balance is quick, easy, and unobtrusive. It allows for quick loan disbursement through a series of simple actions. From Rs.1,000 to Rs.60,000, there’s something for everyone. True Balance is India’s most popular money-making app. If you’re looking for a way to supplement your income, try True Balance. You may work from home or anywhere. Start your own company with no money down.

Feature of the True Balance Instant Cash Loan:

Some of the key features and benefits of True Balance are listed as follows:

- With Instant Cash Loan, you can get a personal loan with flexible payments.

- Your credit limit will be determined based on the results of our survey.

- Loan amounts range from 500 to 5000 rupees, with a 14-week repayment period.

- Interest rates range from 920 percent to 240 percent, with an equal monthly interest rate of 3-11 percent and an annual percentage rate of 36 percent to 240 percent. There is no processing cost.

- For example, a $500 loan would have a $100 (20%) interest rate and no extra fees.

- Apply for a Personal Loan of up to Rs. 50,000 for a period of up to 6 months (30 percent APR)

- Quick approval, fast credit, and no paperwork

- Platform fees are 25%, and there are no pre-closure fees.

The Customer Care Number for the True Balance Personal Loan :

Immediately report such cases to [email protected] OR call our customer care number 0120-4001028 and report the same to us with a screenshot of the message and calls of fraudsters.

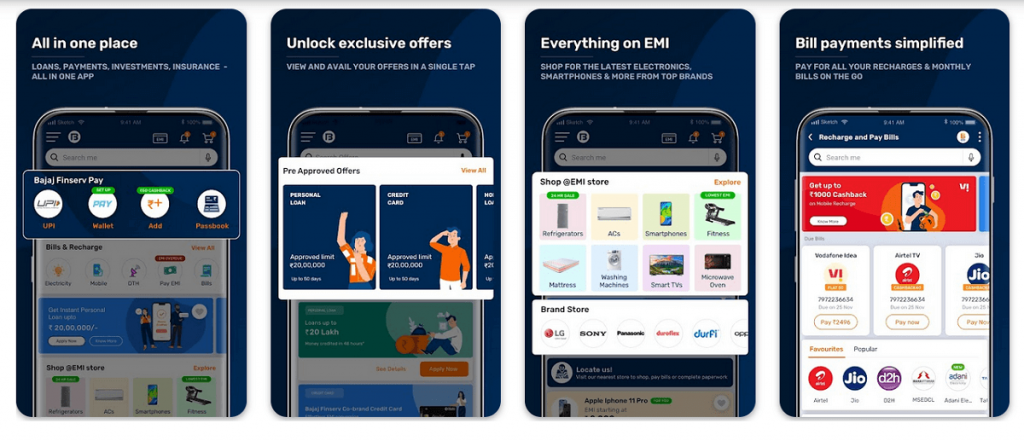

#11 Bajaj Finserv

A medical emergency, wedding, long-overdue vacation, home renovation, acquiring a gadget or household product, and other financial needs, requirements, or crises are all covered by a Bajaj Finserv fast personal loan. This collateral-free loan from Bajaj Finserv is available for up to Rs. 15 lakh, with terms ranging from 12 to 60 months.

Features and Benefits of Bajaj Finserv Instant Personal Loan: –

Some of the key features and benefits of Bajaj Finserv are listed as follows:

- Bajaj Finserv ensures that all financial challenges are addressed, and consumers can apply for a personal loan of up to Rs. 15 lakh with ease.

- A personal loan from Bajaj Finserv is readily available, and the loan application process is simple to follow, allowing for immediate approval.

- Personal loan with flexibility: Customers can borrow up to Rs. 15 lakhs with a 45 percent cheaper EMI thanks to the Flexi Personal loan option.

- Documentation is required at a minimum: You only need to submit a few papers online to get a Bajaj Finserv Personal Loan.

- With the help of personal loan you can easily invest in stock markets and mutual funds as well.

The Customer Care Number for the Bajaj Finserv Personal Loan :

Give a missed call on +91 98108 52222 with your registered mobile number and get instant details of your last 3 relationships with Bajaj Finserv via SMS

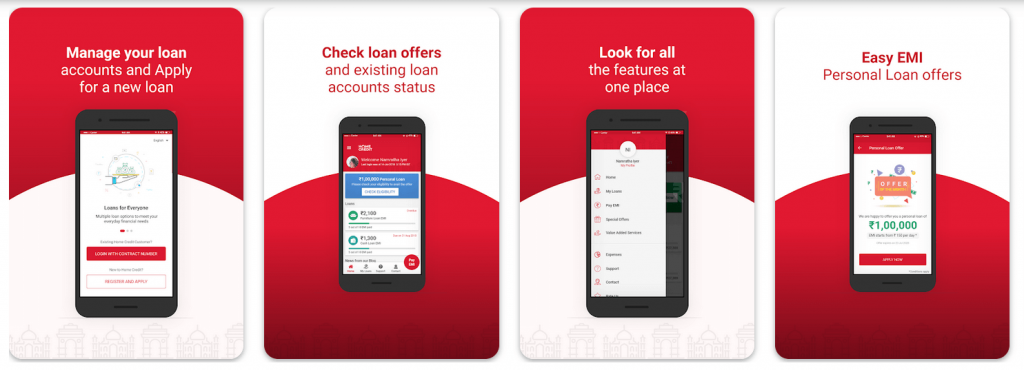

#12 Home Credit

The Home Credit app is currently one of the most popular finance apps. The app takes care of your financing needs quickly and efficiently, allowing you to concentrate on expanding your business and achieving your personal objectives. As a result, it has reached a larger number of people, allowing them to escape financial marginalization. The app’s popularity has skyrocketed in the past several years. This phenomenal growth rate attests to the demand for the use of its services. If you’re an Android user, you can get the app from the Google Play Store.

Features of Home Credit Standard Loan

Some of the key features and benefits of Home Credit are listed as follows:

- A loan of up to $100,000 is available for qualifying buyers.

- Loan repayment lengths range from six to twenty-four months.

- While there is no set amount for a down payment, Home Credit encourages making the largest down payment feasible to reduce monthly payments.

- A processing fee of 3% of the loan amount is charged.

- At least two legitimate IDs are required, one of which must be a primary ID and the other must have a residential address.

- Any of Home Credit’s 3,500 partner stores is available.

- Samsung, Oppo, Acer, ASUS, Toshiba, LG, Nokia, Microsoft, and Lenovo are among the brands available.

The Customer Care Number for the Home Credit Personal Loan :

- +91 – 124 – 662 – 8888

- [email protected]

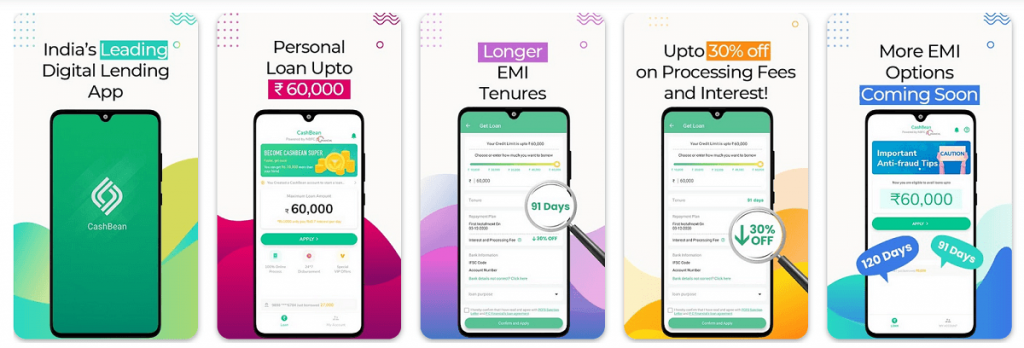

#13 CashBean

CashBean offers up to Rs. 60,000 in quick online personal loans. The interest rate starts at 0.07 percent per day (25.55 percent per annum), and the repayment period is between 3 and 6 months. You can apply for a loan via CashBean’s mobile app or official website, and you’ll have money in your hands in minutes thanks to a digital process.

Features of the CashBean Personal Loan:

Some of the key features and benefits of CashBean are listed as follows:

- You can use a personal loan from CashBean to pay for things like shopping, paying off credit card debt, paying utility bills, paying school fees, buying consumer durables or high-end electronics, organizing a family vacation, as a down payment on your purchases, and so on.

- CashBean offers loans ranging from Rs. 1,500 to Rs. 60,000.

- The CashBean interest rate is reasonable, starting at 0.07 percent every day (25.55 percent per annum). The maximum interest rate is 26 percent per annum.

- Repayment: The loan can be repaid over a three-to-six-month period.

- Processing fees: The one-time personal loan processing charge varies between Rs. 90 and Rs. 2,000, plus an 18% GST.

The Customer Care Number for the CashBean Personal Loan :

Email to Customer Service at: [email protected]

Call at Customer Service Hotline Number: 180 0572 8088 or 0124 – 603 6666, Daily from 9AM to 8PM, except public holidays.

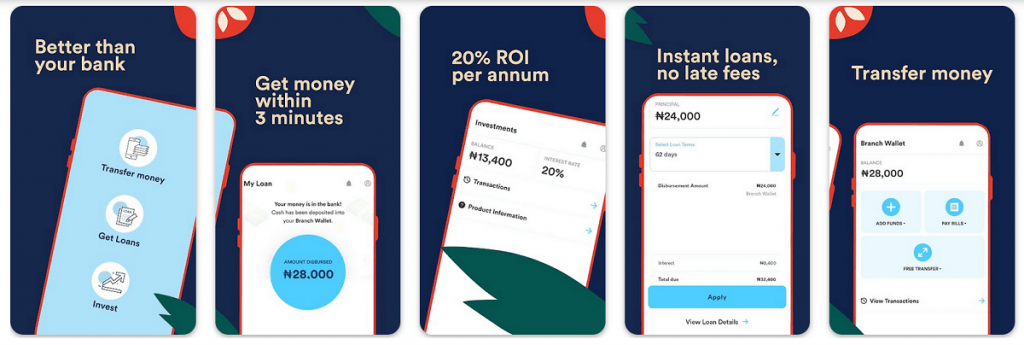

#14 Branch App

Branch provides loans ranging from 750 to 50,000 dollars. Loan lengths range from four to thirty-six weeks. Depending on your loan selection, interest ranges from 3% to 25%, with an equivalent monthly interest of 2.8 percent to 3.1 percent and an APR of 35 percent to 36 percent. There are no late or rollover fees, and there is no requirement for collateral. Interest rates are influenced by a variety of factors, including your repayment history and the branch’s cost of borrowing.

Features of Branch Loan :

Some of the key features and benefits of the Branch app are listed as follows:

- There are no late fees or rollover costs on loans.

- There is no need for documentation, collateral, or office visits.

- Free credit score checks

- Easy access 24 hours a day, 7 days a week.

- Signing up is simple and quick. Use your money for whatever you desire, whether it’s for your house or your business.

- Lower costs and more flexible repayment options as you pay back your loan.

The Customer Care Number for the Branch app Personal Loan :

Contact : 866-547-2413

Email-I’d : [email protected]

Conclusion

A personal loan is the best alternative for someone who needs money for an unexpected need. Personal loans are available from practically all banks and financial organizations, although the process might be lengthy. Documentation procedures can be time-consuming. Aside from that, you’ll need a spotless credit history. Because of its inherent advantages, The finest rapid loan app in India without wage slips should be an appropriate solution in such instances.

Important Note

All the above information taken from official website of personal loan apps and other resources. If any user thinks that the information is wrong or recently updated from the platform then feel free to reach out to [email protected] so, we can update it accordingly.